The Monetary Gains of Offshore Company Formations for SMEs

Demystifying Offshore Firm Formations: Exactly How They Run and What to Expect

Offshore business formations can appear complicated and enigmatic. Offshore Company Formations. These entities, often developed for tax obligation benefits and personal privacy, operate under one-of-a-kind legal frameworks. Business owners might find themselves steering through a labyrinth of regulations and compliance demands. Understanding the details is important for success. What are the genuine benefits? What are the potential challenges? A closer evaluation discloses the subtleties that could affect decision-making significantly

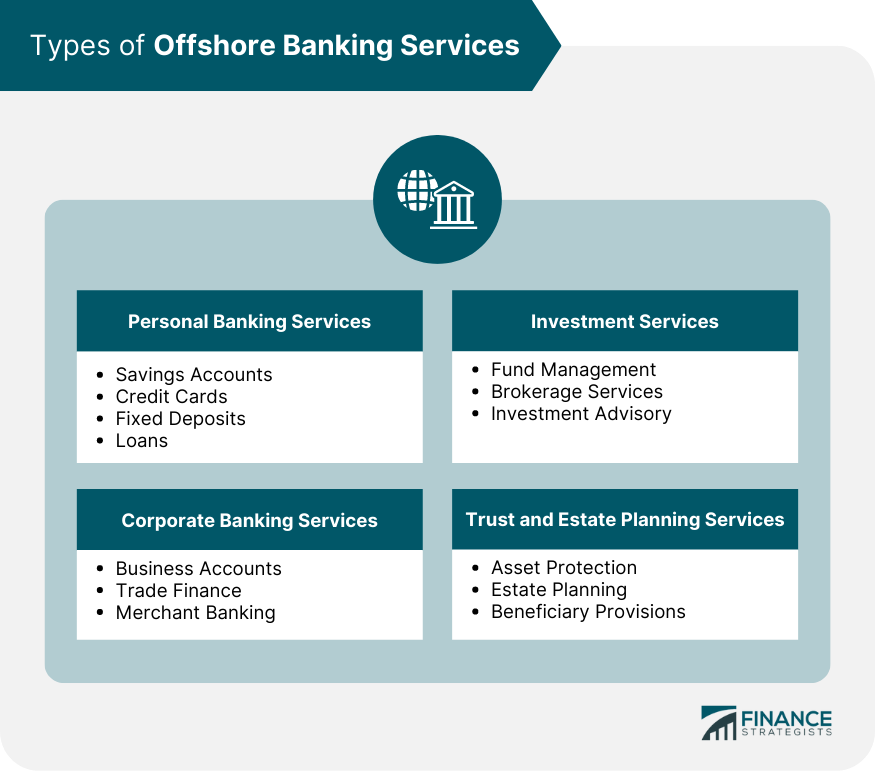

Recognizing Offshore Companies: Interpretations and Kinds

Offshore business are entities established in a territory beyond an individual's or company's main nation of house, usually for purposes associated with tax optimization, possession defense, or governing advantages. These business can take numerous kinds, consisting of minimal responsibility business (LLCs), global organization firms (IBCs), and offshore trusts. Each type serves specific features and allures to various demands.

Minimal responsibility firms supply proprietors with defense from individual responsibility, while global business firms are prominent for their flexibility and marginal coverage demands. Offshore counts on, on the other hand, are used mainly for estate planning and asset defense.

The option of jurisdiction considerably influences the company's operations, as some areas provide much more beneficial legal structures and personal privacy securities. Offshore Company Formations. Comprehending the distinctions in between these kinds is important for businesses and individuals taking into consideration overseas frameworks, as each alternative brings different ramifications for governance and compliance

The Advantages of Establishing an Offshore Firm

Establishing an offshore company can provide countless benefits, particularly for those looking for to improve their economic methods and safeguard their assets. One substantial advantage is tax obligation optimization; numerous jurisdictions use beneficial tax obligation rates or exceptions, allowing organizations to maintain more earnings. Additionally, overseas companies can give a layer of privacy, securing the identities of proprietors and investors from public scrutiny.

One more benefit is possession defense. By placing properties in an overseas entity, individuals can safeguard their wide range from prospective lawful claims or political instability in their home countries. This framework likewise promotes worldwide company procedures, enabling much easier accessibility to global markets and varied customers.

Moreover, the facility of an offshore business can enhance reliability and reputation, interesting clients who value worldwide organization techniques. Overall, these advantages make overseas company formations an attractive alternative for individuals and companies intending for economic growth and security.

Trick Considerations Prior To Developing an Offshore Entity

Before developing an overseas entity, a number of crucial aspects have to be examined. Legal conformity requirements, tax effects and benefits, as well as territory choice, play a substantial role in the decision-making procedure. Understanding these factors to consider can assist people and services browse the complexities of overseas firm formations efficiently.

Lawful Conformity Needs

When considering the development of an overseas entity, understanding legal conformity needs is crucial to guarantee adherence to both international and neighborhood legislations. Prospective service owners should acquaint themselves with policies controling firm enrollment, reporting obligations, and operational criteria in the chosen jurisdiction. This includes confirming the lawful needs for directors and investors, as well as making sure conformity with anti-money laundering (AML) and know-your-customer (KYC) guidelines. In addition, services must continue to be aware of any type of licensing demands details to their sector. Involving local lawful and financial professionals can offer useful understandings, ensuring that all necessary documents is prepared and sent appropriately. Inevitably, thorough knowledge of lawful compliance aids minimize threats and cultivates a lasting offshore operation.

Tax Ramifications and Benefits

Many entrepreneur think about the tax ramifications and benefits of forming an overseas entity as an essential consider their decision-making process. Offshore companies can use considerable tax benefits, such as lowered business tax prices, exception from certain local tax obligations, and the capability to defer tax obligations on foreign income. These advantages can cause enhanced profitability and cash money circulation, making offshore frameworks appealing for worldwide business procedures. In addition, the potential for tax obligation treaties may better lessen tax liabilities. It is vital for company proprietors to understand the complexities entailed, consisting of compliance with both regional and global tax guidelines. Engaging with tax professionals is a good idea to browse these complexities successfully and guarantee suitable tax preparation strategies.

Jurisdiction Choice Variables

What factors should one consider when choosing a territory for overseas company formation? Secret factors to consider include tax effectiveness, regulative setting, and political security. Territories with desirable tax obligation regimens can significantly affect earnings. The regulative landscape must supply adaptability and simplicity of conformity, permitting for efficient business procedures. Political security is important, as it assures the security of assets and continuity of operations. Additionally, the credibility of the jurisdiction can affect client trust and business partnerships. Ease of access to banking solutions and the availability of professional assistance solutions are also vital. Understanding neighborhood regulations concerning ownership, coverage, and privacy needs is crucial to ascertain that the overseas entity aligns with the organization proprietor's objectives and legal obligations.

The Refine of Setting Up an Offshore Business

Establishing an overseas company includes a collection of tactical actions that call for mindful planning and compliance with global laws. A specific must select an appropriate territory that lines up with their organization objectives and provides beneficial tax obligation benefits. Complying with territory choice, the following action is to pick an unique company name and prepare the necessary Our site documentation, including short articles of consolidation and shareholder agreements.

Once the documentation prepares, it should be submitted to the relevant authorities along with the called for costs. After approval, the company will certainly receive a certification of unification, formally developing its lawful existence. The specific have to after that open a company savings account to facilitate economic purchases.

Lastly, maintaining an offshore company includes sticking to continuous compliance needs, such as yearly coverage and tax obligation responsibilities, which vary by territory. Recognizing each action is necessary for a successful overseas company development.

Lawful and Regulative Framework for Offshore Firms

While establishing an offshore firm can provide substantial advantages, it is necessary to steer through the complicated legal and regulative framework that regulates such entities. Each territory has its very own set of regulations that dictate whatever from business formation to taxation and compliance needs. These regulations are developed to avoid illegal activities, such as cash laundering and tax obligation evasion, and typically need thorough documentation and transparency.

Secret aspects of this structure consist of the need of selecting local directors, keeping a registered workplace, and sticking to yearly coverage commitments. Additionally, numerous jurisdictions impose particular licensing demands for sure company activities. Comprehending these legal specifications is critical for guaranteeing conformity and mitigating dangers related to charges or lawful conflicts. Engaging with legal specialists that specialize in offshore firms can help in maneuvering via this detailed landscape, eventually helping with a certified and successful offshore service operation.

Usual Mistaken Beliefs Concerning Offshore Firms

Many individuals hold misconceptions about offshore business, frequently equating them with tax evasion and unlawful activities. It is crucial to recognize that these entities can operate lawfully within a framework created for legitimate service practices. Clarifying the legal status of offshore firms can aid dispel these myths and promote a much more exact understanding of their function.

Tax Evasion Misconceptions

Regardless of the growing appeal of offshore firms, mistaken beliefs concerning their usage for tax evasion persist. Numerous people mistakenly think that establishing an overseas entity is solely a means to avoid taxes. Overseas companies are typically made use of for legitimate purposes, such as property protection, international business expansion, and investment diversity. The assumption that all offshore tasks relate to immoral tax evasion neglects the intricacies of worldwide tax laws and compliance requirements. Additionally, the vast majority of overseas territories have actually carried out procedures to battle tax obligation evasion, advertising openness and information exchange. This mischaracterization can deter genuine businesses and financiers from discovering the possible advantages of offshore firm formations while continuing an adverse preconception bordering these entities.

Legal Standing Clarified

The legal condition of overseas companies is frequently misconstrued, causing a range of misunderstandings. Many think these entities run in a legal grey location, assuming they are naturally unlawful or unethical. Actually, overseas business are legitimate companies created under the laws of specific territories, made for numerous reasons, including possession security and market development. Another typical mistaken belief is that overseas business escape taxes completely; however, they are subject to the laws and tax responsibilities of their home nations. In addition, some individuals believe that offshore companies can be website link quickly manipulated for cash laundering or prohibited activities. While misuse can happen, a lot of territories enforce strict conformity and transparency regulations to minimize such risks, guaranteeing that overseas business run within legal structures.

Handling and Running Your Offshore Firm Successfully

Effectively managing and operating an overseas business calls for a tactical technique that stabilizes conformity with regional laws and the search of company goals. Effective overseas administration entails recognizing the territory's tax obligation regulations, reporting needs, and functional laws. Using local specialists, such as accounting professionals and lawful consultants, index can supply very useful understandings right into passing through these complexities.

Furthermore, establishing clear communication networks and functional protocols is crucial for keeping performance. Making use of modern technology for task monitoring and cooperation can boost efficiency, while routine performance assesses guarantee alignment with tactical objectives.

Furthermore, maintaining robust economic documents is important, as transparency fosters trust fund with stakeholders and follow worldwide standards. Being versatile to modifications in regulation or market problems allows overseas companies to pivot successfully, guaranteeing lasting sustainability and growth. By sticking to these concepts, organization owners can make best use of the benefits of their overseas ventures while mitigating dangers.

Frequently Asked Concerns

Just how much Does It Cost to Keep an Offshore Business Annually?

The expense to keep an offshore business each year differs significantly, typically ranging from $1,000 to $5,000, relying on territory, services needed, and conformity obligations. It is necessary to take right into account extra fees for details requirements.

Can I Open a Checking Account for My Offshore Firm From Another Location?

Opening up a checking account for an offshore business from another location is usually possible. However, demands might differ by territory, frequently requiring documents and confirmation procedures, which can make complex the remote application experience for people.

Exist Details Nations Recognized for Easier Offshore Firm Formations?

Certain countries, such as Belize, Seychelles, and the British Virgin Islands, are renowned for their streamlined procedures and favorable regulations concerning offshore firm formations, attracting entrepreneurs looking for effectiveness and confidentiality in business procedures.

What Kinds of Companies Are Best Matched for Offshore Business?

Certain organizations, such as shopping, consultancy, and financial investment companies, typically gain from overseas business due to tax obligation advantages, personal privacy, and regulatory adaptability - Offshore Company Formations. These entities generally flourish in jurisdictions that advertise beneficial service environments

Just How Can I Make Certain Conformity With Neighborhood Legislations When Operating Offshore?

To assure compliance with regional legislations when operating offshore, it is vital to engage legal specialists, carry out comprehensive study on jurisdiction guidelines, and maintain transparent economic records, thus minimizing risks associated with non-compliance.